Job Retention Scheme Planner

£0.00

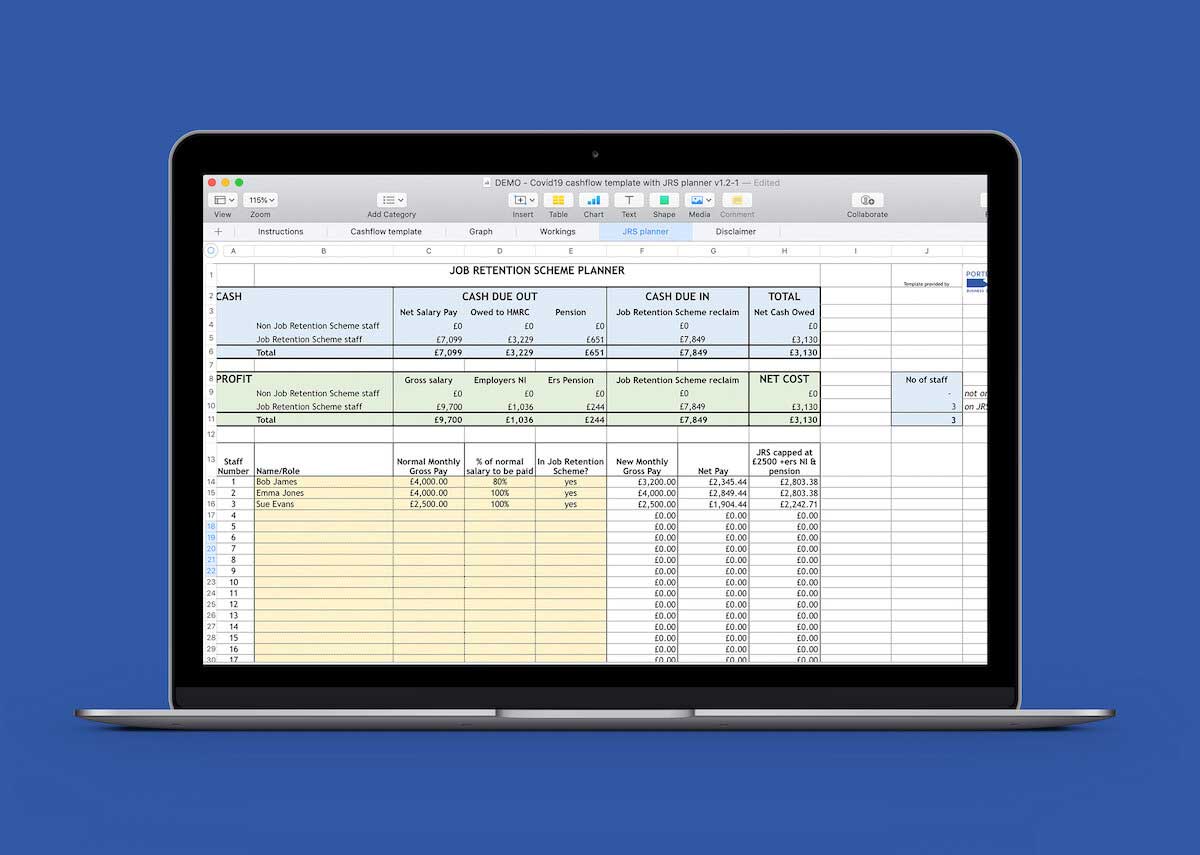

This monthly planner shows the cash and profit impact of putting up to 50 individual monthly paid staff members on the Job Retention Scheme before it closes at the end of March 2021.

The model has a simple yes/no scheme toggle for each employee, 100%/80% for the % of normal salary they will be paid and takes into account the monthly JRS cap for each employee.

Inputting the monthly salary, or monthly equivalent for weekly paid staff, the planner works out the PAYE, NI and pension based on standard tax codes. This saves time by quickly giving an overview rather than having to work out employee records individually.

The model gives a summary of the net pay, the amount owing to HMRC and the amount due back under JRS. These amounts can be linked to other spreadsheets for scenario planning and decision making.